Small and medium enterprises (SMEs), often described as the backbone of Bangladesh’s economy, are facing a dual crisis of financing shortages and falling sales. According to Bangladesh Bank data, SME loan disbursement fell year-on-year from Tk 53,107 crore in early 2024 to Tk 47,821 crore in the first three months of 2025, marking a 10% decline. At the same time, defaults have climbed to Tk 4.80 lakh crore, accounting for 20.2% of total loans, the highest bad loan ratio in Asia.

Read More: Chittagong Port to Boost River Trade and Heavy Cargo Handling with New Deals

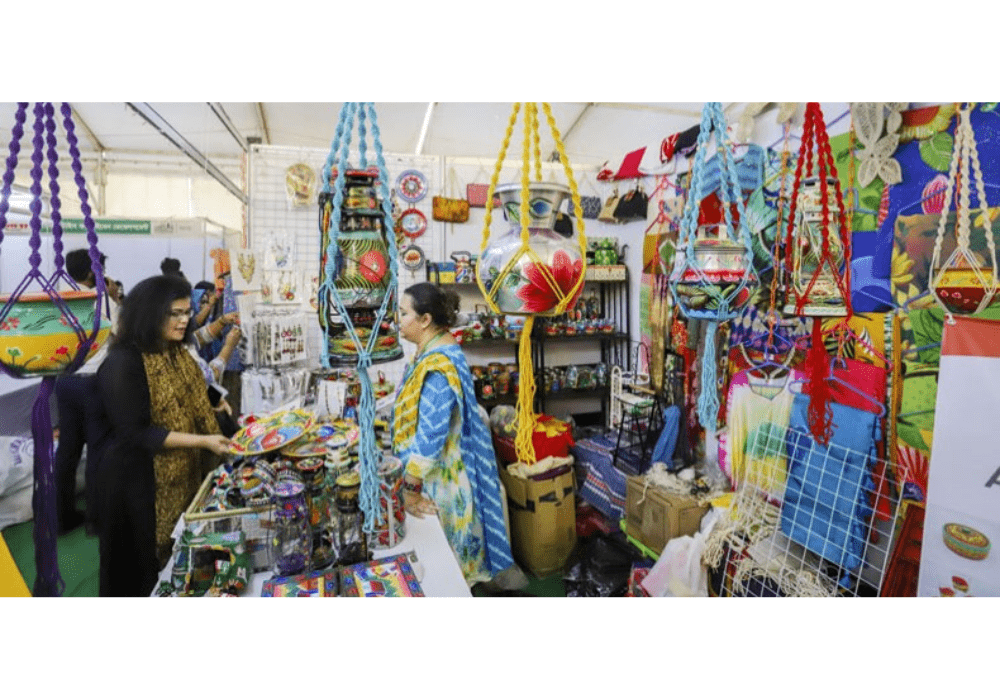

For the country’s 78 lakh SMEs, which contribute nearly one-fourth of GDP and 69.9% of manufacturing value addition, the impact has been severe. Producers in sectors like cricket bat accessories and Manipuri sarees report sales plunging by 40 to 70 percent, with monthly turnovers dropping from Tk 2 lakh to as low as Tk 50,000. Inflation, standing at 8.29% in August, has cut into consumer spending power, further reducing demand.

Banks, burdened by rising non-performing loans and shaken trust, have become increasingly cautious in lending. Entrepreneurs complain that loan requests of Tk 50 lakh are being cut down to Tk 20 to 25 lakh, while even small loans of Tk 1 lakh are being delayed. This financing gap has left many SMEs unable to sustain operations or invest in growth, despite their critical role in employment and economic stability.

Read More: Exports Through Hili Land Port Cross Tk30cr in Three Months

Industry experts and trade bodies warn that unless banks adopt a more SME-friendly approach with simplified procedures, collateral-free credit, and tailored financial products, Bangladesh’s SME sector risks prolonged stagnation. A recent analysis estimates that only 28 out of 100 SMEs currently have access to formal credit, leaving a financing gap of about $2.8 billion. Without urgent intervention, the sector’s contribution to growth, jobs, and innovation could face long-term setbacks.