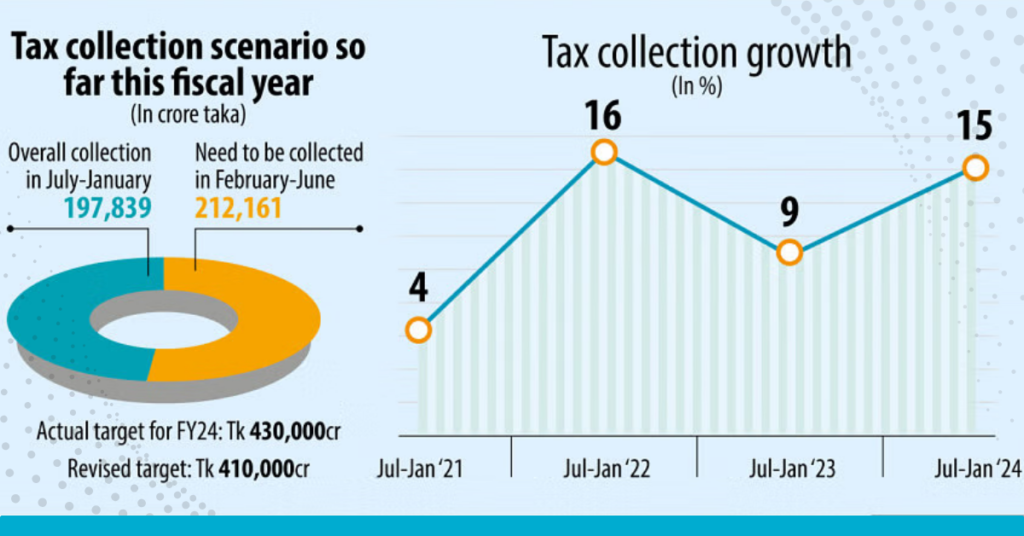

In January, the pace of revenue collection accelerated, primarily attributed to increased income tax receipts as the deadline for filing personal income and wealth statements for the current fiscal year concluded last month. According to provisional data from the National Board of Revenue (NBR), all three wings—customs, value-added tax (VAT), and income tax—saw a 15 percent year-on-year increase in tax collection, totaling Tk 197,839 crore for the July-January period of the fiscal year 2023-24.

Despite the growth, the tax administration fell short of its target by Tk 17,750 crore, even after a 4.5 percent reduction in the collection target by the government. The NBR’s revised tax collection goal for FY24 is Tk 410,000 crore, with only 48 percent achieved in the seven months leading up to January.

Towfiqul Islam Khan, a senior research fellow at the Centre for Policy Dialogue, noted that achieving the revised tax collection target for the entire year seems unlikely. He highlighted the challenges posed by higher inflation, the depreciation of the taka against the US dollar, and other foreign currencies, emphasizing the need for judicious choices in public expenditure.

Income and travel tax exhibited an 18 percent growth to Tk 63,074 crore from July to January compared to the previous year, while VAT collection, the government’s largest revenue source, increased by 16 percent to Tk 77,224 crore. The NBR attributed the rise in VAT receipts to increased consumer prices or inflation.

Customs revenue, impacted by foreign currency shortages and a nearly 20 percent decline in overall imports, recorded the lowest growth. With imports totaling $30.5 billion in July-December 2023-24, customs revenue grew by almost 10 percent to Tk 57,540 crore in the same period.

Economist Muhammad Shahadat Hossain Siddiquee expressed concern about the revenue collection shortfall, with a monthly deficit averaging over Tk 2,500 crore. While acknowledging the effectiveness of revenue authorities in the current economic context, he emphasized the challenge of achieving the ambitious tax-to-GDP ratio increase set by the International Monetary Fund (IMF) as part of the loan conditions for FY24. The economic challenges stemming from the lingering impacts of the coronavirus pandemic and the Russia-Ukraine war further complicate the government’s revenue collection objectives.