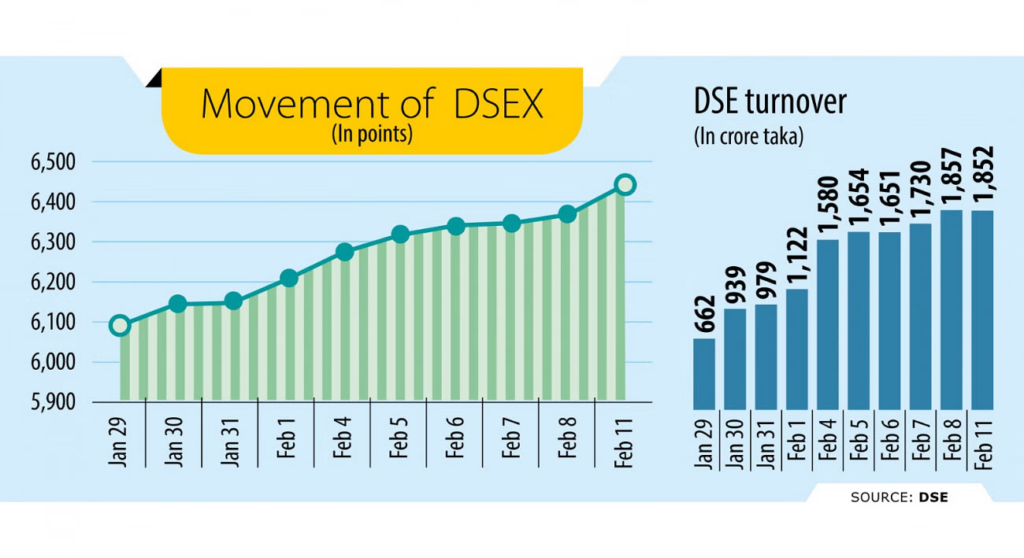

Investors on the Dhaka Stock Exchange (DSE) witnessed a positive trend as shares continued to surge over the past 10 days, fostering hopes of further stock price increases. The DSEX, the benchmark index, rose by 73 points, or 1.16 percent, closing at 6,447, marking a 16-month high. This upward trajectory persisted for 10 consecutive trading days, last seen on October 16, 2022, when the index reached 6,478 points.

Blue-chip companies in the DSE 30 Index experienced a 21-point increase, closing at 2,159, while the DSE Shariah Index (DSES) advanced by 10 points to 1,398. Despite a slight dip in turnover from Tk 1,858 crore to Tk 1,853 crore, retail investors enthusiastically engaged in the market, anticipating rising stocks in the coming month.

Read more: World Bank’s Insights on Inflation and Economic Policies in Bangladesh

However, concerns were raised about investors relying on rumors rather than conducting thorough research, leading to a sluggish rise in stocks for companies with commendable performance records. The hope for improved 2023 performances from banking companies drove investors to purchase associated stocks, anticipating dividend announcements.

Major sectors experienced varied movements, with banking stocks leading the gains at 4.29 percent, followed by non-bank financial institutions at 4 percent. Conversely, the engineering sector faced a 1.45 percent erosion. Among the traded issues, 165 advanced, 196 declined, and 33 closed unchanged.

Top gainers included South Bangla Agriculture & Commerce Bank (10 percent), Social Islami Bank (9.90 percent), and Mithun Knitting and Dyeing (9.89 percent). Conversely, Shyampur Sugar Mills faced the most significant loss at 8.74 percent, followed by Renwick Jajneswar & Co (Bd) (5.70 percent) and Intech (5.61 percent).

Read more: Discover Essential Marketing Newsletters

The Chittagong Stock Exchange also experienced an upswing, with the Caspi, its broad index, surging by 309 points, or 1.69 percent, reaching 18,605.

In conclusion, the Dhaka Stock Exchange demonstrated sustained positive momentum, setting a 16-month high. While certain sectors experienced notable gains, concerns were raised about investors relying on rumors rather than conducting diligent research. The anticipation of improved performances from banking companies and dividend announcements drove market participation. Overall, the market displayed resilience and optimism among investors, contributing to the prolonged upward trend.

Source: The Daily Star