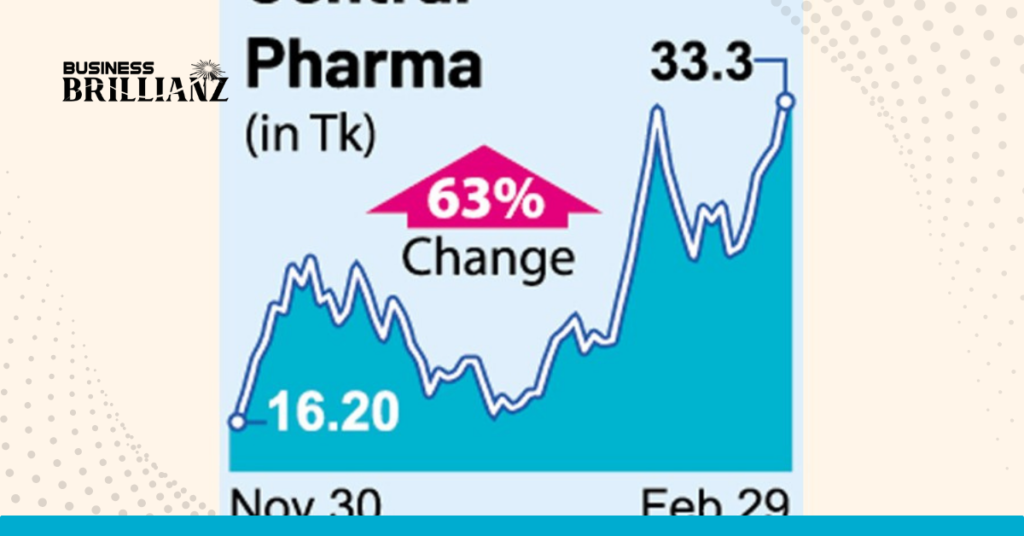

Central Pharmaceuticals Limited’s stock price has experienced a remarkable surge of over 63% within just one month on the Dhaka Stock Exchange (DSE). This surge has occurred despite the absence of apparent catalysts to justify the heightened investor interest in the company.

Central Pharmaceuticals Limited, a drug manufacturer, has faced losses for the past four consecutive years, accumulating losses totaling Tk 1.23 billion by the end of FY’23. The company has not distributed any dividends since FY’19 when it disbursed only a 1.0% cash dividend for its shareholders. Additionally, the auditor identified significant irregularities in the company’s financial statements, including areas such as income, expenses, inventories, deferred tax, fixed assets, undistributed dividends, tax payments, and bank accounts.

Despite these challenging circumstances, the company’s stock has continued to soar, rising by 24.72% in the current week and dominating the weekly turnover chart. DSE data reveals that approximately 51.93 million Central Pharma shares were traded during the week, generating a turnover of Tk 1.60 billion, accounting for 4.53% of the week’s total turnover.

Central Pharma’s stock has frequently appeared on the top gainers’ and top turnover lists, even as the company reports sustained losses, with a reported loss of Tk 18 million for the July-December period of the current year. Over the past three months, the stock price more than doubled, closing at Tk 33.30 on Thursday, despite no disclosure of price-sensitive information.

This unusual price movement prompted the Dhaka Stock Exchange to issue show-cause notices to the company authority multiple times, seeking explanations for the unexpected surge. In response, the company claimed that there was no undisclosed price-sensitive information that could have influenced the stock price.

Listed on the capital market in 2013, Central Pharma has consistently remained in the group of B category stocks, despite not declaring any dividends after FY’19. The company is one of 14 currently under inspection by the DSE to uncover the actual situation of their factories, as some are non-operational but have refrained from making such information public.

The sharp increase in the share price of this loss-making company has raised questions, with analysts suspecting potential price manipulation behind the surge. Despite the prevailing downturn affecting many stocks, the unusual rise in Central Pharma’s stock price, without manipulation, is deemed unlikely, suggesting potential manipulation by a vested group targeting firms with a low number of stocks for easy manipulation and capitalizing on general investors seeking quick gains.