British American Tobacco Bangladesh (BATB) posted a 3.7 per cent growth in profit for the April-June (Q2) this year, compared to the same quarter of the previous year, thanks to higher domestic sales and lower operating expenses.

The cigarette manufacturer’s net profit stood at Tk 5.12 billion in the June quarter, up from Tk 4.94 billion in the same quarter a year ago, according to its unaudited financial statements published on Thursday.

Accordingly, earnings per share stood at Tk 9.48 in April-June this year as against Tk 9.14 in the same quarter of the previous year.

The multinational company’s net sales also grew by 9 per cent year-on-year to Tk 28.91 billion in the June quarter, while operating expenses declined 4 per cent to Tk 2.65 billion during the quarter, leading to profit growth.

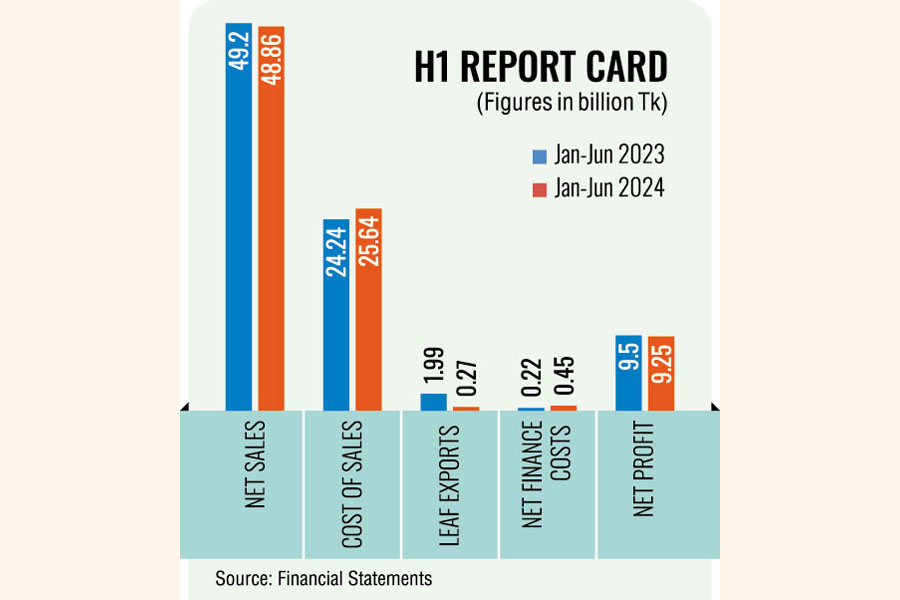

The company’s half-yearly profit, however, dropped slightly by 2.6 per cent to Tk 9.25 billion, down from Tk 9.50 billion the same period of the previous year, due to higher production costs and increased finance expenses.

Also, the company’s half-yearly net sales fell 0.70 per cent to Tk 48.86 billion as against Tk 49.20 billion in the same period of the previous year.

Read more: Pragati Life Insurance declares 14% cash dividend

Lower leaf exports, higher production costs and increased finance expenses have negatively impacted the profit growth, said a company official declining to be named.

The company’s leaf exports plunged 86 per cent year-on-year to Tk 276.4 million in January-June this year.

The company’s costs of sales also increased amid higher input costs along with sharp devaluation of local currency against the US dollar.

The cost of sales, which includes all associated costs to produce cigarettes, stood at Tk 25.64 billion in January-June this year, which was 52.48 per cent of total sales during the time, up from 49.27 per cent of total sales in the same period last year.

The company managed to offset some of the costs by increasing sale prices but failed to make up owing to rising inflation and higher tax payment, said the company official.

BAT Bangladesh paid a 7.14-percent higher supplementary duty and value added tax (VAT) to the government exchequer in January-June this year over the same period a year before despite lower sales.

Read more: The Core Skills of a Great Leader

On top of that, its net finance expenses jumped more than doubled year-on-year to Tk 446 million in January-June this year.

The net asset value, which refers to the excess of total assets over total liabilities, reached Tk 106.47 per share as of June this year, up from Tk 83.85 in June 2023.

BAT Bangladesh declared a 100 per cent cash dividend for 2023, the lowest in over a decade, despite maintaining almost the same net profit as in the previous year.