Bangladesh recorded a 20 percent increase in foreign direct investment (FDI) in the fiscal year 2024-25, with net inflows reaching 1.71 billion dollars, according to central bank data. The recovery comes after a three-year low in FY24, which was caused by political uncertainty surrounding national elections and reduced investor confidence.

Economists and business leaders welcomed the growth as a positive sign of renewed investor interest, but they warned that the current FDI volume is still far below what is needed to achieve Bangladesh’s long-term development goals.

Read More: Trust Bank, ACI Motors Sign MoU to Offer 0% EMI on Yamaha Motorcycles

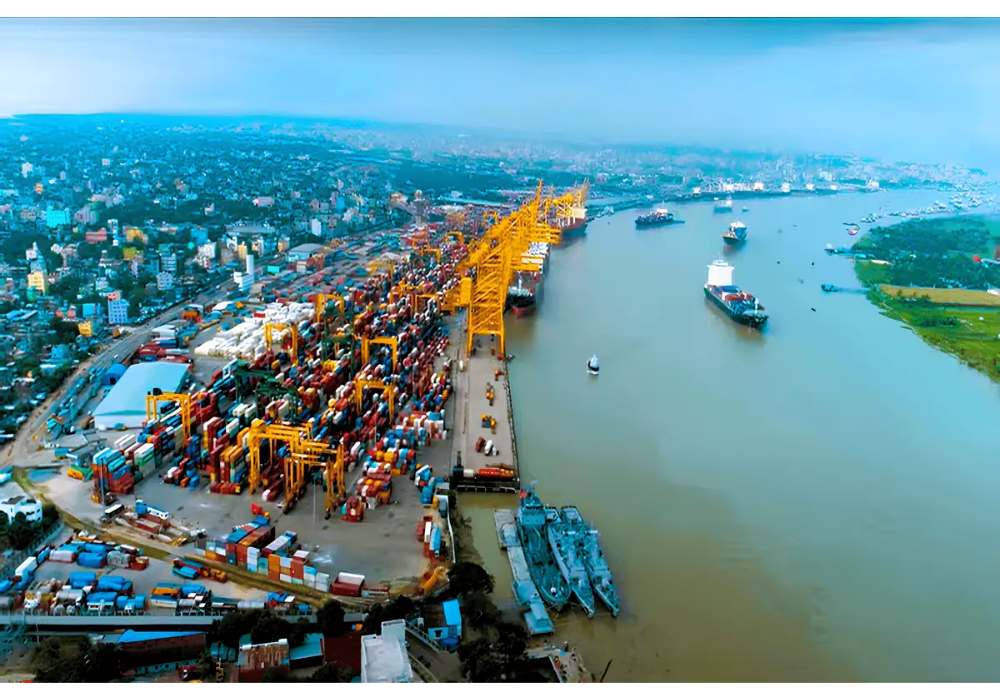

Syed Akhtar Mahmood, former lead private sector specialist at the World Bank, said it is important to distinguish between new investments and reinvestments by existing companies. He stressed the need to attract fresh greenfield investments in export-oriented sectors, energy, logistics, and emerging industries.

Rupali Chowdhury, former president of the Foreign Investors’ Chamber of Commerce and Industry (FICCI), said Bangladesh needs at least 8 billion dollars in annual FDI to achieve its growth targets, while current inflows remain between 1.5 billion and 3 billion dollars. She pointed out that Vietnam attracted around 36 billion dollars and India over 28 billion dollars in 2024, showing how far Bangladesh lags behind. She also urged the government to improve infrastructure, resolve gas and power shortages, and enhance logistics facilities to boost investor confidence.

Ashraf Ahmed, former president of the Dhaka Chamber of Commerce and Industry (DCCI), said the recent rise in FDI is a positive sign but noted that the overall base remains low. He emphasized the need for political stability, regulatory reforms, and better macroeconomic management to create a stronger investment environment.

Read More: BSEC Tightens Margin Loan Rules Minimum Tk 5 Lakh Investment Required

M Masrur Reaz, chairman and CEO of the Policy Exchange of Bangladesh, also described the rise as encouraging but stressed that inflows are still far below what is required for long-term growth.

Experts also noted that much of the recorded FDI reflects decisions made earlier, meaning the impact of recent reforms may not yet be visible. Without structural changes, Bangladesh risks falling behind regional competitors in attracting large-scale greenfield projects.