A new IFC-GlobalData report shows Bangladesh attracted only $1.8 billion in logistics FDI from 2019 to 2024, just 4.9% of South Asia’s total. Experts call for stronger policies, infrastructure, and incentives to tap into the region’s booming logistics market.

Bangladesh has drawn only a small portion of South Asia’s logistics-related foreign direct investment (FDI), according to a recent study published by the International Finance Corporation (IFC) and GlobalData. Between 2019 and 2024, the country received $1.8 billion in greenfield FDI, representing just 4.9 percent of the region’s total logistics investment.

Read More: When Virality Outshines Value: The Salt Bae Case

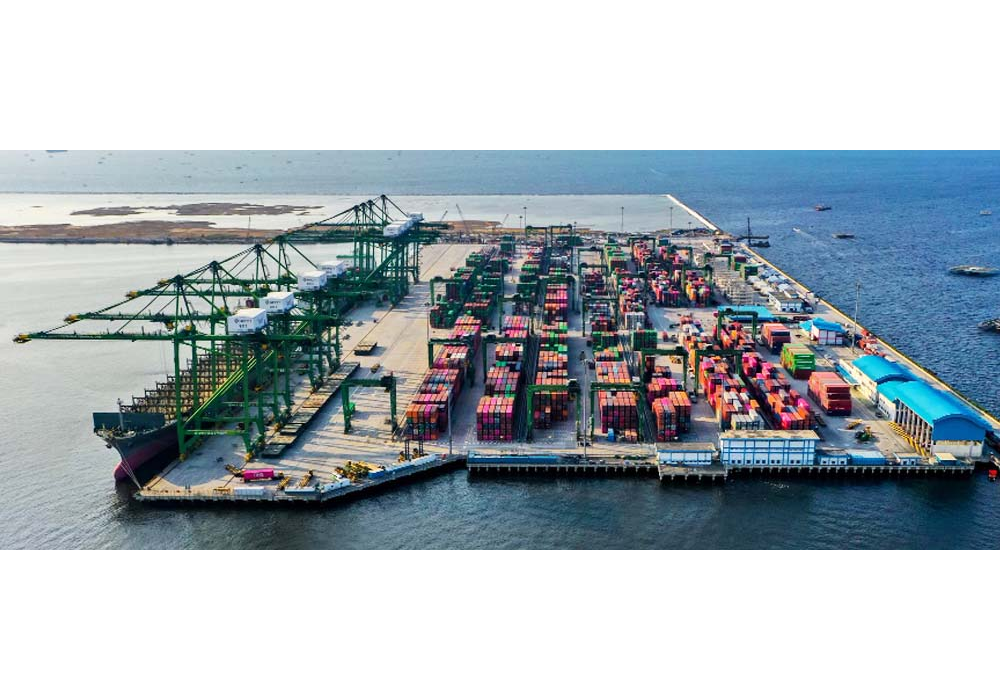

During this period, Bangladesh registered 10 projects in logistics and warehousing, along with an additional $185.6 million in investment in sales and administration functions linked to the sector. Notable projects include UAE-based Abu Dhabi Ports’ plan to invest $1 billion in a multipurpose terminal under the Bay Terminal project in Chattogram, and Denmark’s AP Moller-Maersk announcing a $400 million investment for a new container terminal in Laldia, Chattogram.

In comparison, South Asia recorded 258 logistics FDI projects, with India alone accounting for 85 percent of the total. The report highlights that while global trade dynamics are shifting due to politics, technology, and policy changes, Bangladesh’s logistics sector has yet to capture significant foreign interest.

To remain competitive, the report recommends that Bangladesh adopt a strategic approach to logistics planning, emphasizing dual-use infrastructure that supports both international trade and the growing domestic market. It also urges the government to promote green logistics solutions to attract sustainable investments and develop smart logistics systems to reduce inefficiencies such as delays, excessive paperwork, and resource wastage.

Experts believe Bangladesh’s current logistics gap limits its global competitiveness. M Masrur Reaz, Chairman and CEO of the Policy Exchange of Bangladesh, noted that efficient logistics are critical for the country’s export-led economy. “Our competitiveness depends on faster delivery and lower freight costs, both of which rely on efficient logistics,” he said. Reaz added that Bangladesh lags behind Vietnam, Thailand, and India due to underdeveloped infrastructure and restrictive regulations.

Read More: Chattogram Port to Go Fully Digital by February 2026

He emphasized that with the right strategies, Bangladesh could attract billion-dollar investments across ports, river terminals, multimodal transport, and inland container services. “Strategic investment can not only boost exports but also bring world-class logistics operators to Bangladesh, adding credibility to our investment landscape,” Reaz said.

The report concludes that Bangladesh must now move beyond limited participation and actively pursue targeted incentives, modernized infrastructure, and smart technology integration to position itself as a regional logistics hub.