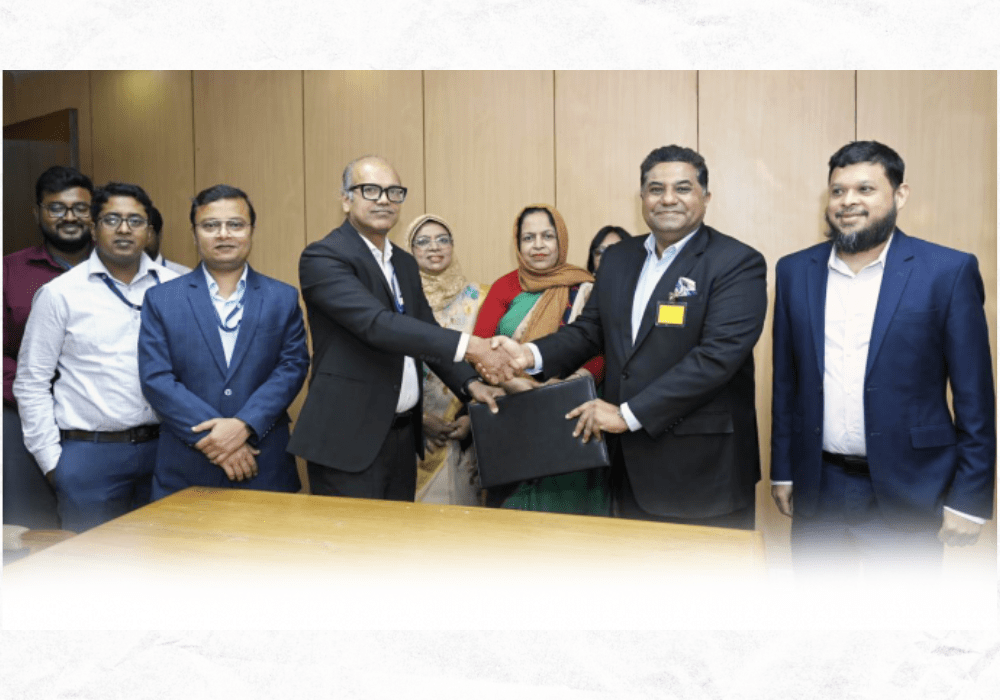

Bangladesh Bank, in partnership with IPDC Finance PLC, has introduced a Tk 500 crore Startup Equity Investment Fund to strengthen the country’s entrepreneurial landscape. The fund is designed to provide both equity investment and low-cost financing, with a special focus on supporting women-led enterprises and innovation-driven ventures.

According to the guidelines, eligible startups must be registered in Bangladesh, hold valid trade or RJSC licenses, and demonstrate innovation in products, services, or technology. Entrepreneurs aged 21 and above will have the opportunity to secure financing between Tk 2 crore and Tk 8 crore at an interest rate of just 4%.

Read More: Akij Ceramics hosts ‘BOND & BEYOND’ Architects’ Day Out 2025 at Royena Resort

Bangladesh Bank Governor Dr. Ahsan H Mansur described the initiative as a “game-changer,” saying it will champion disruptive ideas, women’s leadership, and inclusive growth, positioning Bangladesh for a more competitive economy.

IPDC Managing Director Rizwan Dawood Shams echoed this sentiment, highlighting that the collaboration goes beyond financing. “Through this partnership with Bangladesh Bank, we are fueling startups with more than just capital. We are igniting the confidence and opportunities they need to soar,” he said.

Read More: Bloomberg ESG Ranking Features 11 Bangladeshi Companies

The launch event was attended by senior leaders, including Deputy Governor Nurun Nahar, Executive Director Husne Ara Shikha, Additional Director Muhammad Mustafizur Rahman, and Ashique Hossain, Deputy Managing Director of IPDC Finance.

Industry experts see the move as a significant milestone for Bangladesh’s startup ecosystem, providing entrepreneurs with the resources to innovate, scale, and contribute to the country’s long-term economic growth.