In Bangladesh, the embrace of agent banking has led to a notable surge in the number of women with bank accounts, surpassing their male counterparts. This trend is attributed to the enhanced accessibility and guidance that agent banking provides for various financial services, particularly benefiting those residing in rural areas.

According to the latest data from the Bangladesh Bank, the tally of savings accounts initiated through agents reached 2.14 crore by the end of December 2023. Among these account holders, 1.04 crore were men, 1.06 crore were women, and the remaining 3.29 lakh fell into the “others” category, encompassing business accounts. Agent banking, a form of branchless banking utilizing local intermediaries, has emerged as a solution to extend financial services into localized communities.

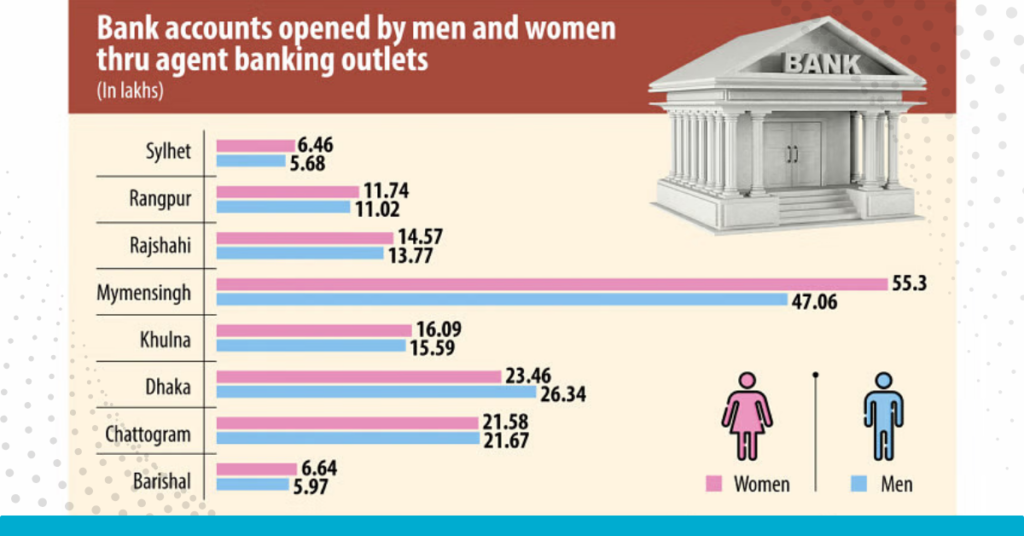

Notably, the number of female account holders exceeded their male counterparts in several divisions including Barishal, Khulna, Mymensingh, Rajshahi, Rangpur, and Sylhet, signifying that agent banking has played a pivotal role in augmenting women’s participation in the financial landscape.

Md Mohibur Rahman, head of agent banking at City Bank PLC, explained that the surge in women opting for agent banking outside Dhaka is due to the longstanding presence of traditional banking in areas like Dhaka and Chattogram. Consequently, there is a significant opportunity, especially for rural women, to become financially included through agent banking.

M Khorshed Anowar, deputy managing director and head of retail and SME banking at Eastern Bank PLC, outlined various facilities that attract women to open agent banking accounts. These include fingerprint transactions, easy remittance reception, accessible locations, swift and straightforward services, emphasis on small savings, utility bill payments, and specialized products. Anowar highlighted that EBL’s agent banking outlets organize community engagement programs to promote financial inclusion among marginalized and unbanked populations.

The security factor is also a notable aspect contributing to women’s preference for agent banking. City Bank’s Mohibur mentioned the introduction of a two-factor authentication system called token management, requiring both fingerprint and token number for any transaction, enhancing security for customers.

Raising awareness, particularly among rural women, to enhance financial literacy is a top priority for institutions promoting agent banking. The data reveals 15,757 agents and 21,601 agent banking outlets nationwide, with a significant portion located in rural areas. Rural agents outnumber urban agents by 5.3 times, and rural outlets surpass urban outlets by six times, underscoring the popularity of agent banking as an accessible option for rural residents.

In terms of transactions, the data for December 2023 showed 94.02 lakhs transactions with a total amount of Tk 44,261 crore through agent banking outlets. Significantly, both the number and amount of transactions were higher in rural areas, indicating the high demand and utilization of agent banking services among rural and underprivileged populations.

Agent banking, introduced in Bangladesh in 2013, serves as a conduit to extend financial inclusion to the unbanked and underbanked segments, particularly in remote and rural areas. As the numbers continue to soar, agent banking emerges as a transformative force in reshaping the financial landscape, fostering inclusivity, and empowering women economically across the nation.