Bangladesh’s packaged food industry is expanding at one of the fastest rates in the region, with the market projected to reach 5.8 billion dollars by 2030. The sector, currently valued at 4.8 billion dollars, is being reshaped by rapid urbanisation, rising incomes and a growing shift toward ready to eat and processed food items, said Khondaker Golam Moazzem, research director at the Centre for Policy Dialogue.

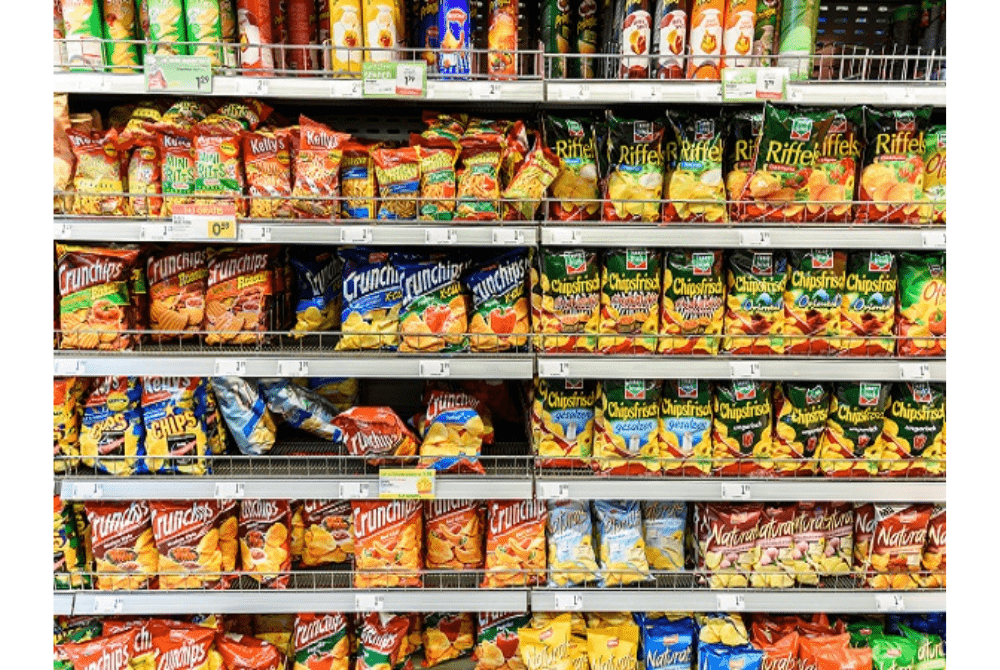

Speaking at a workshop on agri and agro processing in Dhaka’s Gulshan, Moazzem noted that nearly 40 percent of the population now lives in urban areas, leading to changing food habits. Branded and hygienically packaged items such as biscuits, noodles, frozen parathas, juices and snacks are increasingly dominating both domestic markets and export baskets.

Read More: 5 AI Companies by Market Capitalization as of November 2025

Citing data from the Bangladesh Agro Processors Association, he highlighted that biscuits alone generated 88.5 million dollars in export earnings, followed by strong performances from noodles and frozen parathas. With incomes rising, he said demand for premium packaged foods will grow even further.

He referred to Bangladesh Bureau of Statistics projections showing that household spending will continue shifting toward processed and ready to cook items by 2030. Moazzem described the sector’s transformation as similar to “a tadpole turning into a frog,” reflecting its evolution from small scale cottage setups to large scale, export oriented manufacturing.

Despite the momentum, the sector faces persistent challenges. Cold chain infrastructure remains inadequate, while high interest rates, unstable power supply and bureaucratic delays continue to hinder investment. Foreign direct investment in the food processing sector reached 379 million dollars in the 2024–25 fiscal year, driven mainly by Dutch investors. But Bangladesh’s upcoming graduation from the Least Developed Country category will reduce access to export subsidies, putting more pressure on manufacturers to improve productivity, safety and compliance.

Moazzem warned that only 12 percent of agro processing firms currently meet international food safety certification standards, which limits access to premium markets such as Europe and North America. He stressed the need for a one stop digital investment portal, improvements in labour governance and the adoption of green technologies to strengthen competitiveness.

He also emphasised shifting policy support away from cash incentives toward more sustainable measures such as low cost financing, technology upgrades and research driven development initiatives.

Read More: MGH Group to Launch New Airline ‘Fly Falcon’ in Partnership with UAE-Based FZE

At the event, Kamruzzaman Kamal, marketing director of Pran RFL Group, noted that the company now exports to 148 countries and sources most of its raw materials from local farmers. He said that Bangladesh’s agro processed products are now meeting international quality standards, but better systems for raw material collection, processing and marketing are essential for further progress.

Dhaka Tribune editor Reaz Ahmad highlighted the media’s role in supporting the industry. He said that by showcasing the success of farmers, innovations and export potential, the media can influence perception, policy and growth in the agro processing sector and contribute to national economic development.